For an international capital-flow shock in which foreign investors lose confidence in a country

A. the country's real domestic product is affected if the country has a floating exchange rate but not affected if the country has a fixed exchange rate.

B. the country's real gross domestic product (GDP) decreases regardless of whether the country has a fixed or floating exchange rate, but the country's real GDP declines less if the country has a floating exchange rate.

C. the country's real GDP tends to decline if the country has a fixed exchange rate, but the country's real GDP tends to increase if the country has a floating exchange rate.

D. the country's real domestic product is affected if the country has a fixed exchange rate but is not affected if the country has a floating exchange rate.

Answer: C

You might also like to view...

Appreciation of the dollar will make imported goods more expensive and shift the aggregate demand curve outward

a. True b. False Indicate whether the statement is true or false

An economy with a trade surplus will experience a net inflow of international financial capital

a. True b. False Indicate whether the statement is true or false

The natural rate of real output reflects the levels of ______ in the economy.

a. capital, land, labor, and technology b. prices c. consumption, investment, imports, and taxes d. wages

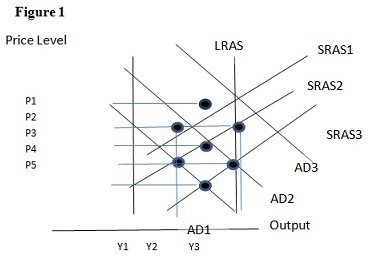

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the short run would be:

A. P1 and Y2. B. P2 and Y3. C. P3 and Y1. D. P2 and Y2.