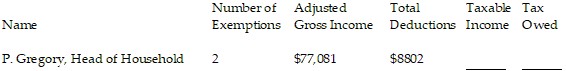

Find the amount of taxable income and the tax owed. The letter following the name indicates the marital status, and all married people are filing jointly. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the following tax rate schedule.

A. $64,579; $10,912.25

B. $61,181; $10,062.75

C. $64,881; $10,987.75

D. $60,879; $9987.25

Answer: D

Mathematics

You might also like to view...

The angle ? is an angle in standard position and satisfies the given conditions. Find the indicated trigonometric function value of ?. Do not use a calculator.The terminal side of ? is in quadrant I and lies on the line  Find

Find

A.

B. 8

C.

D.

Mathematics

Solve the system.

A. inconsistent (no solution) B. (0, -5) C. dependent (many solutions) D. (-1, -4)

Mathematics

Determine whether the two matrices are inverses of each other by computing their product. and

and

A. No B. Yes

Mathematics

Find the standard form of the equation of the parabola with the given characteristic and vertex at the origin.

?

Directrix:

A.

B.

C.

D.

E.

Mathematics