When an international financial crisis occurs

A. financial flows can slow to a trickle, influencing economic growth.

B. there are no serious financial effects that last more than a few months.

C. investors sell off bonds and restrict loans as a mechanism to help the country recover.

D. financial lenders protect their investments by pouring money into the ailing country.

Answer: A

You might also like to view...

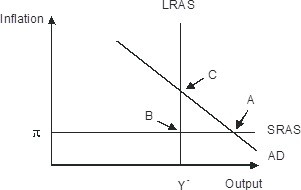

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C

Based on the figure below. Starting from long-run equilibrium at point C, a decrease in government spending that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at__ creating _____gap.

A. B; no output B. D; an expansionary C. B; recessionary D. D; a recessionary

Any dollar amount received by a seller above the marginal cost of production is known as a

A. producer surplus. B. willingness to accept. C. consumer surplus.

In the long run, perfectly competitive firms earn just enough revenue to

A) pay all fixed costs. B) pay all accounting costs. C) pay all opportunity costs. D) attract entry.