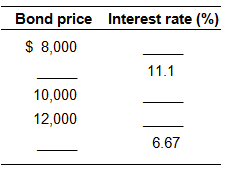

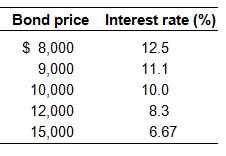

Suppose that a bond having no expiration date has a face value of $10,000 and pays a fixed amount of interest of $1000 annually. Compute and enter in the spaces provided either the effective interest rate which a bond buyer could receive at the new price or the bond price (rounded to the nearest $1000) required to receive the interest rate shown.

You might also like to view...

Which of the following will not result in a rightward shift of the market supply curve for labor?

a. an increase in immigration b. an increase in labor productivity c. an increase in the working-age population d. a decrease in nonwage income

How many résumés should you have?

A. One. B. One tailored to each job you apply for. C. Between 5 and 10 which cover the majority of companies.

The data on U.S. nominal interest rates and inflation rates tends to:

A. serve as evidence against the Fisher Effect, since nominal interest rates and inflation rates seem to move in opposite directions. B. serve as evidence against the Fisher Effect, since nominal interest rates and inflation rates seem to move in the same direction. C. provide support for the Fisher Effect, since nominal interest rates and inflation rates seem to move in opposite directions. D. provide support for the Fisher Effect, since nominal interest rates and inflation rates seem to move in the same direction.

If logrolling occurs during the creation of a highway construction bill, this means that

A. members of Congress are agreeing to support someone else's highway, so that other members will support their own projects. B. the bill is moved so fast through the process that no member of Congress can get their project included. C. members of Congress are taking bribes. D. the total costs are being trimmed.