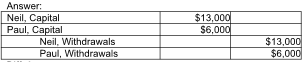

Neil and Paul formed a partnership. During the year, Neil and Paul withdrew $13,000 and $6,000, respectively. Provide the journal entry to close the withdrawal accounts. Omit explanation.

What will be an ideal response?

You might also like to view...

Sales reps might have better insight into developing trends than any other group, and forecasting might give them greater confidence in their sales quotas and more incentive to achieve them

Indicate whether the statement is true or false

How can proofreading be seen as an ethical responsibility of a communicator?

Hunter Sailing Company exchanged an old sailboat for a new one. The old sailboat had a cost of $280,000 and accumulated depreciation of $140,000. The new sailboat had an invoice price of $297,000. Hunter received a trade in allowance of $141,000 on the old sailboat, which meant the company paid $156,000 in addition to the old sailboat to acquire the new sailboat. If this transaction lacks commercial substance, what amount of gain or loss should be recorded on this exchange?

A. $140,000 loss B. $141,000 gain C. $0 gain or loss D. $1000 loss E. $1000 gain

Scotch, Inc has prepared the operating budget for the first quarter of the year

The company forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows: Variable Expenses: Power cost (20% of sales) Miscellaneous expenses: (5% of sales) Fixed Expenses: Salaries expense: $8,000 per month Rent expense: $5,000 per month Depreciation expense: $1,400 per month Power cost/fixed portion: $500 per month Miscellaneous expenses/fixed portion: $1,000 per month Using the information above, calculate the amount of selling and administrative expenses for the month of February. A) $28,400 B) $33,400 C) $15,000 D) $30,900