When a tax is based on the difference between the market value of the taxpayer's assets and liabilities, it is called

A. a difference tax.

B. a wedge tax.

C. a personal net worth tax.

D. an implied liability tax.

C. a personal net worth tax.

You might also like to view...

List and define the two categories of after-tax corporate profits

What will be an ideal response?

The average food stamp payment in 2010 was?

A. $150 B. $435 C. $0 D. $287

An example of an employer tax credit is the EITC

Indicate whether the statement is true or false

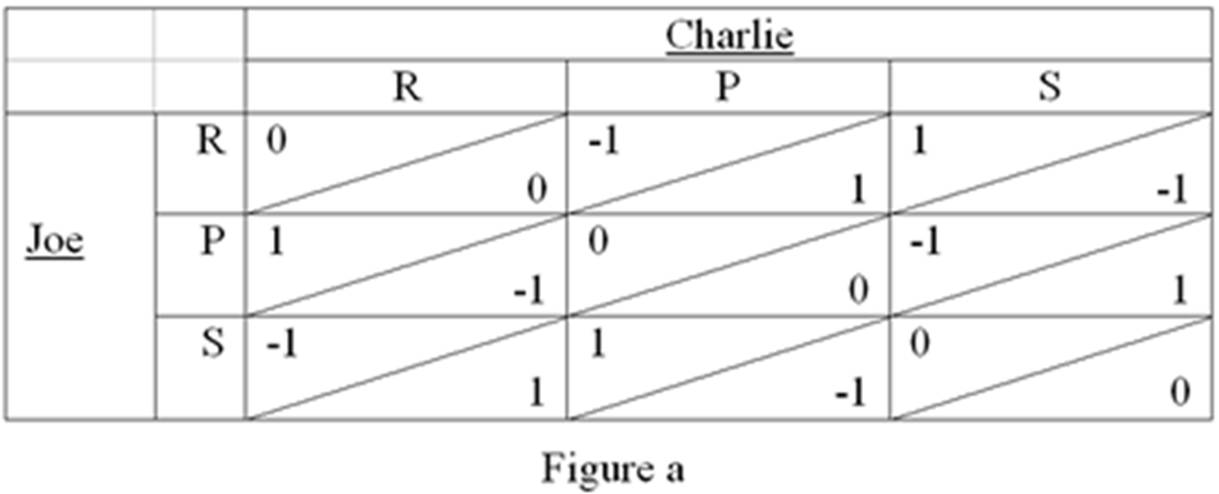

Refer to Figure a. Charlie and Joe both want to ride shotgun with their mother, so they play a game of rock-paper-scissors to determine who gets to sit in the front seat. In the table, -1 represents a loss, 1 a win and 0 a tie, and Joe's payoff is shown in the upper left-hand corner of each cell, while Charlie's appears in the lower right-hand corner. What is the Nash equilibrium?

A. Charlie chooses rock, Joe chooses rock

B. Charlie chooses rock, Joe chooses paper

C. Charlie chooses paper, Joe chooses scissors

D. There is no Nash equilibrium.