What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

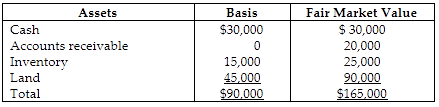

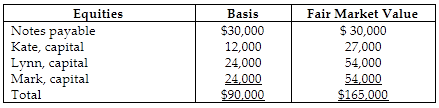

On December 31, Kate receives a $28,000 liquidating distribution from the KLM Partnership. On that date, Kate's basis in her limited partnership interest is $18,000 (which, of course, includes her share of partnership liabilities). The other partners assume her $6,000 share of liabilities. Just prior to the distribution, the partnership has the following balance sheet. Kate is leaving the partnership but the partnership is continuing.

Divide the payments between Sec. 736(a) and Sec. 736(b) payments.

Total received ($28,000 + $6,000) $34,000

Minus: FMV of assets (Sec. 736(b)) ( 33,000)

Sec. 736(a) payment - guaranteed payment taxable as ordinary income $ 1,000

Analysis of the Sec. 736(b) payment of $33,000.

Kate is first deemed to receive her share of Sec. 751 assets from the partnership and then immediately sell them to the partnership for cash.

The remaining Sec. 736(b) payment of $24,000 ($33,000 - $9,000 deemed paid for the Sec. 751 assets) is analyzed as a liquidating distribution.

Predistribution basis in partnership $18,000

Minus: Sec. 751 deemed distribution ( 3,000)

Basis in partnership interest after Sec. 751 transaction $15,000

Minus: remaining Sec. 736(b) distribution ( 24,000)

Excess or capital gain to be recognized $ 9,000

Summary: Kate recognizes a $1,000 guaranteed payment, $6,000 of ordinary income, and a $9,000 capital gain.

You might also like to view...

Marcos Inc had net income for 2014 of $40,000 . It declared and paid a $3,500 cash dividend in 2014 . If the company's retained earnings for the end of the year was $38,200, what was the company's retained earnings balance at the beginning of 2014?

a. $81,700 b. $74,700 c. $5,300 d. $1,700

Sample size is directly affected by the variability of the characteristic in the population

Indicate whether the statement is true or false

The black box approach to testing computer applications allows the auditor to explicitly review program logic

Indicate whether the statement is true or false

The gross profit method of estimating inventory would NOT be useful when

a. a periodic system is in use and inventories are required for interim statements. b. there is a significant change in the mix of products being sold. c. inventories have been destroyed or lost by fire, theft, or other casualty, and the specific data required for inventory valuation are not available. d. the relationship between gross profit and sales remains stable over time.