A tax that causes the price that producers receive for a commodity to deviate from the buyer's price is

A. an unit tax.

B. a compensated tax.

C. an income tax.

D. a price-distorting tax.

D. a price-distorting tax.

You might also like to view...

The reason for the use of the "averaging equation" to compute the price elasticity of demand is that

a. it would be impossible to connect a change in price specifically to a change inquantity demanded otherwise b. the elasticity within a price range differs depending on whether you are measuring price increases or decreases c. otherwise, the answer is sometimes negative and sometimes positive d. it measures sensitivity to price changes more accurately e. economists find the average elasticity to be a useful tool in their research

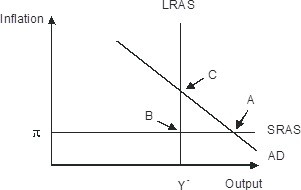

The economy pictured in the figure has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; A B. recessionary; C C. recessionary; B D. expansionary; A

If government adhered strictly to an annually balanced budget, the government's budget would

A. vary in a countercyclical fashion. B. tend to destabilize the economy. C. have no impact upon domestic output and employment. D. tend to stabilize the economy.

Profit per unit is the difference between

A) average revenue and average total cost. B) marginal revenue and marginal cost. C) total revenue and total cost. D) average revenue and marginal cost.