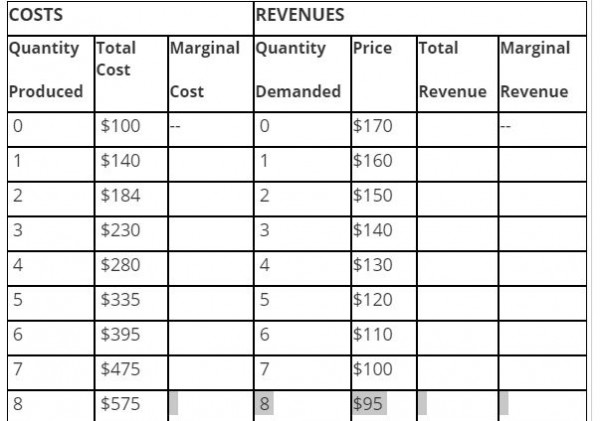

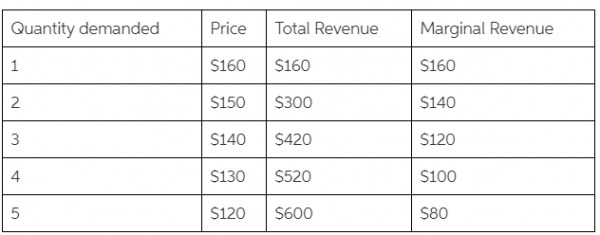

Tommy’s Tie Company, a monopolist, has the following cost and revenue information. Assume that Tommy’s is able to engage in perfect price discrimination.

Refer to Table 15-21. If the monopolist can engage in perfect price discrimination, what is the marginal revenue from selling the 5th tie?

a. $80

b. $100

c. $110

d. $120

Answer: a. $80

The marginal revenue from selling the 5th tie is equal to the difference between the total revenue by selling 5 ties and the total revenue by selling 4 ties.

So the marginal revenue by selling the 5th tie = $600 - $520 = $80

You might also like to view...

Overall, what type of economy are we in today?

A. Creative B. Agricultural C. None of the options listed. D. Knowledge E. Industrial

A price floor that sets the price of a good above market equilibrium will cause:

a. a decrease in quantity demanded of the good. b. an increase in quantity supplied of the good. c. a surplus of the good. d. all of these.

A bank's assets consist of $1,000,000 in total reserves, $2,100,000 in loans, and a building worth $1,200,000 . Its liabilities and capital consist of $3,000,000 in demand deposits and $1,300,000 in capital. If the bank is required to keep reserves equal to one-third of deposits, what is the level of the bank's excess reserves? How much money could the excess reserves be used to create in the

banking system as a result? a. zero; zero b. $300,000; $300,000 c. $300,000; $900,000 d. $700,000; $2,100,000

The $/€ bid rate is the:

a. Equal to the €/$ ask rate b. Inverse of €/$ bid rate c. Inverse of $/€ ask rate d. Equal to the $/€ ask rate e. Inverse of €/$ ask rate