Answer the following statements true (T) or false (F)

1. Specialization based on comparative advantage will shift a nation's production possibilities curve outwards.

2. Through international trade an economy can consume a combination beyond its domestic production possibilities curve.

3. If the U.S. dollar depreciates against the euro, then it will be easier for U.S. exporters to sell their products in Europe.

4. In the dollar/yen market, if the supply of yen increases other things being equal, the dollar will appreciate.

5. Relatively high rates of U.S. inflation compared to other countries will increase the supply of, and decrease the demand for, dollars in foreign exchange markets.

1. F

2. T

3. T

4. T

5. T

You might also like to view...

Which of the following forms the largest share of gross domestic product in the United States, when measured using the expenditure method?

A) Investment expenditure B) Government expenditure C) Foreign expenditure on domestic goods D) Expenditure on consumption

Which of the following is true of the relationship between the marginal cost function and the average total cost and average variable cost functions?

A) If MC is greater than ATC and AVC, then ATC and AVC will increase. B) The ATC and AVC curves intersect the MC curve at minimum MC. C) The MC curve, ATC curve, and AVC curve all intersect at the same point. D) At each level of output, MC is equal to difference between AVC and ATC.

Assume that the expectation of declining housing prices cause households to reduce their demand for new houses and the financing that accompanies it. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the GDP Price Index and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. The GDP Price Index falls, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). b. The GDP Price Index rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). c. The GDP Price Index falls, and net nonreserve-related international borrowing/lending becomes more positive (or less negative). d. The GDP Price Index and net nonreserve-related international borrowing/lending remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

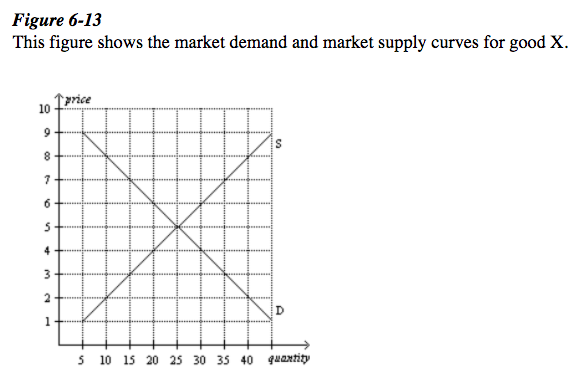

Refer to Figure 6-13. Which of the following price floors would be binding in this market?

a. $3

b. $4

C. $5

d. $6