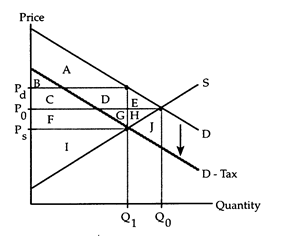

Refer to Sales Tax. Area C + D + F + G

The following questions refer to the accompanying diagram which shows the effects of a sales tax imposed on consumers. The initial price and quantity are P0 and Q0, respectively. After the tax is imposed, the equilibrium quantity is Q1, firms receive the price Ps, and consumers pay the price Pd.

a. the total value that consumers receive from their purchases.

b. the tax revenue collected by the government.

c. the fall in producers' surplus.

d. the deadweight loss due to the tax.

b. the tax revenue collected by the government.

You might also like to view...

When attempting to determine if a sales tax is regressive or not, it is important to consider _____

a. bequests b. that a general sales tax is a consumption tax c. that people pay income taxes d. that individual's incomes change over their lifetime

The existence of a natural monopoly stems from the size of the firm relative to the total market demand for the product of that firm

a. True b. False Indicate whether the statement is true or false

Given that unions face a downward-sloping demand curve for labor, which of the following is not true concerning the optimal union wage rate at a given employment level?

A. It is above the labor supply curve. B. It is above the labor demand curve. C. It is above the marginal wage. D. It exceeds the competitive wage.

If total revenue exceeds fixed cost, a firm

A) should produce in the short run. B) has covered its variable cost. C) is making short-run profits. D) may or may not produce in the short run, depending on whether total revenue covers variable cost.