Define tax expenditures. What are the costs and benefits to using tax expenditures for social policy rather than direct government expenditures?

What will be an ideal response?

Tax expenditures are reductions in an individual's tax liability, either through exemptions, deductions, or credits, that are designed to further some social policy goal. One of the potential benefits is that it might be more efficient for government to further a social goal through tax policy than through direct government expenditure. For example, if the direct government expenditure would require a large bureaucracy to oversee and administer the program. The primary cost of using tax expenditures to further social policy goals is that they narrow the tax base and increase the excess burden of the tax system due to the increased distortion and the higher tax rates necessary to raise the same level of revenue.

You might also like to view...

Product-specific services are most likely to be valuable for which of the following goods?

A) a broom B) a lawn tractor C) a shovel D) a lawn rake

Which of the following is not true with regard to economic profit?

a. economic profit equals total revenue minus total cost b. economic profit excludes implicit cost c. economic profit is any profit greater than a normal profit d. firms attempt to maximize economic profit e. long-run economic profit is always zero in perfect competition

Which of the following demonstrates the law of supply? a. When leather became more expensive, belt producers decreased their supply of belts

b. When car production technology improved, car producers increased their supply of cars. c. When sweater producers expected sweater prices to rise in the near future, they decreased their current supply of sweaters. d. When lemon prices rose, lemon growers increased their quantity supplied of lemons.

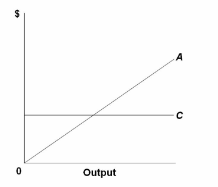

Refer to the diagram, which pertains to a purely competitive firm. Curve A represents:

A. total revenue and marginal revenue.

B. marginal revenue only.

C. total revenue and average revenue.

D. total revenue only.