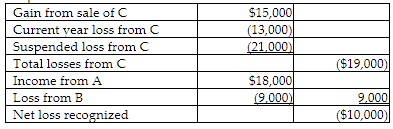

All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable gain. What is Nancy's AGI as a result of these transactions?

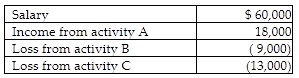

Nancy reports the following income and loss in the current year.

A) $50,000

B) $55,000

C) $64,000

D) $71,000

A) $50,000

Salary of $60,000 less $10,000 passive loss recognized = $50,000 AGI.

You might also like to view...

High-risk, high-yield bonds used to finance mergers, leveraged buyouts, and troubled companies are referred to as:?

A. ?callable bonds. B. ?junk bonds. C. ?convertible bonds. D. ?floating-rate bonds. E. ?putable bonds.

An indorsement limiting payment to a particular person is effective

Indicate whether the statement is true or false

As a form of training and development, Jack attended a gathering where he listened to a speech from someone who was twenty years his senior and had been in the business for forty years. Jack was engaged in what form of training and development?

A. Classroom lecture B. On-the-job learning C. Conference and seminars D. Role-playing E. Simulations

Petrini Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:a.The budgeted selling price per unit is $110. Budgeted unit sales for January, February, March, and April are 7,500, 10,600, 12,000, and 11,700 units, respectively. All sales are on credit. b.Regarding credit sales, 30% are collected in the month of the sale and 70% in the following month. c.The ending finished goods inventory equals 30% of the following month's sales. d.The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $4.00 per pound. e.Regarding raw materials purchases, 40% are paid for in

the month of purchase and 60% in the following month. f.The direct labor wage rate is $23.00 per hour. Each unit of finished goods requires 2.6 direct labor-hours. g.Manufacturing overhead is entirely variable and is $8.00 per direct labor-hour. h.The variable selling and administrative expense per unit sold is $1.70. The fixed selling and administrative expense per month is $70,000. The estimated net operating income (loss) for February is closest to: (Round your intermediate calculations to 2 decimal places.) A. $11,620 B. $81,620 C. $29,640 D. $41,000