A multinational enterprise (MNE) produces a component in the United Kingdom, where the corporate income tax rate is 60 percent. It produces its final product in Taiwan, where the corporate income tax rate is 25 percent. The cost of the component produced in the United Kingdom is $4 per unit. The components can be shipped to Taiwan at almost no cost, and there is no tariff on the component when it is imported into Taiwan. Each unit of the final product requires one unit of the component. Other production costs in Taiwan to complete the final product are $14 per unit. The final product price, when it is sold by the Taiwan affiliate to outside buyers, is $20 per unit. If the goal of the multinational enterprise is to maximize its global after-tax profit, which of the following three choices

should the controller of the multinational enterprise favor? Why?a. Charge a transfer price of $4 per unitb. Charge a transfer price of $5 per unitc. Charge a transfer price of $6 per unit

What will be an ideal response?

POSSIBLE RESPONSE: The multinational enterprise's after-tax global profit depends on what transfer price it sets for the sale of the component by its UK affiliate to its Taiwan affiliate.

| Transfer Price ($ per unit) | UK Affiliate | Taiwan Affiliate | Global MNE | |||

| ? | Before tax profit ($ per unit) | After tax profit ($ per unit) | Before tax profit ($ per unit) | After tax profit ($ per unit) | Before tax profit ($ per unit) | After tax profit ($ per unit) |

| 4 | 0 | 0 | 2 | 1.50 | 2 | 1.50 |

| 5 | 1 | 0.40 | 1 | 0.75 | 2 | 1.15 |

| 6 | 2 | 0.80 | 0 | 0 | 2 | 0.80 |

The table depicts the various amounts of pre-tax and post-tax profits of the MNE affiliates in the UK and Taiwan, as well as the global pre-tax and post-tax profits, for the three different transfer prices. Of the three, the MNE would achieve the highest global after-tax profit by using a transfer price of $4 per unit. The low transfer price allows the MNE to show more of its global profit in the low-tax country.

You might also like to view...

The relationship between the quantity of inputs and the quantity of outputs is called a:

A. production function. B. profit function. C. resource function. D. cost function.

Under average-cost pricing, an increase in the monopolist's production cost will:

A. decrease its profit because its profit per unit decreases. B. not affect its profit because the government adjusts the regulated price equal to the average cost. C. increase its profit because the monopolist can reduce the average cost at a greater output level. D. None of these

Economists tend to distrust voluntary approaches as a way to deal with externalities. What is their most common concern?

A. Voluntary approaches usually require people to ignore their self-interest, and economists do not think people do that well. B. Voluntary approaches are often too effective and lead to excessive reduction in the externality. C. Voluntary approaches often are perceived as unfair, imposing a heavy burden on the poor. D. Voluntary approaches do not make people develop an awareness of the problem that would lead them to make good lifestyle changes.

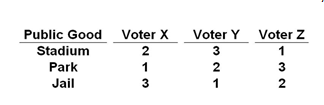

Refer to the table below, which shows the ranked preferences of voters for three alternative projects, with "1" being the top preference. This situation illustrates the voting inconsistency where a majority of voters prefer the:

A. Stadium over the park, the park over the jail, and the jail over the stadium

B. Park and jail over the stadium, and the jail over the park

C. Stadium over the jail, the jail over the park, and the park over the stadium

D. Stadium and jail over the park, and the park over the jail