Suppose the demand for saline solution is perfectly inelastic for contact lens wearers

If the government imposes a tax on saline solution, what occurs? Be sure to tell what happens to the price paid by the buyers and discuss the incidence of the tax.

If demand is perfectly inelastic, then no matter what the price, buyers will not decrease their quantity demanded when the price rises. Hence the tax will be passed along entirely to the consumers. So, in the case of saline solution, the price paid by the buyers will rise by the full amount of the tax and so buyers pay the entire amount of the tax.

You might also like to view...

The Keynesian short-run aggregate supply curve

A) reflects the fact that real GDP is supply-determined. B) reflects the fact that real GDP does not vary with changes in aggregate demand. C) is vertical. D) is horizontal.

Productivity relates to

A) working harder over time. B) working longer over time. C) producing the same output with fewer labor hours. D) producing the same output with more labor hours.

The percentage change in one's real income can be approximated by:

a. Dividing real income by the price level, expressed as an index number b. Dividing the price level, expressed as an index number, by nominal income c. The percentage change in price level minus the percentage change in nominal income d. The percentage change in nominal income minus the percentage change in the price level

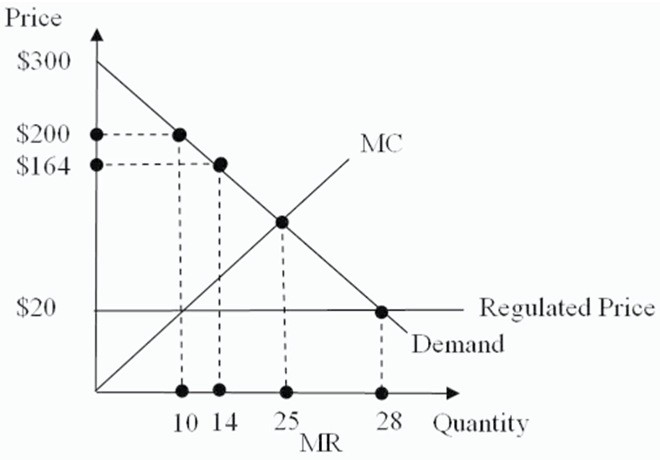

Consider the monopoly in the figure below with price regulated at $20 per unit. The deadweight loss under the regulated price is:

A. $1,350. B. $150. C. $2,300. D. There is insufficient information to compute the deadweight loss at the regulated price.