A product is __________ when it is sold abroad below the current selling price in the exporter's home market or below the exporter's cost of production

a. subsidized

b. dumped

c. underpriced

d. undervalued

b

You might also like to view...

If resistors to change cannot be converted, then they might need to ______.

a. all be gathered into one department so that they are out of the way b. be told that they will no longer be rewarded or promoted c. be neutralized or eliminated d. none of these

Match each of the following terms with the appropriate definitions.

A. The uncollectible accounts of credit customers who do not pay what they have promised. B. The party to whom the promissory note is payable. C. Amounts due from customers for credit sales. D. A contra asset account with a balance approximating the amount of accounts receivable expected to be uncollectible. E. A process of classifying accounts receivable by how long it is past its due date for the purpose of estimating the amount of uncollectible accounts. F. The charge a borrower pays for using money borrowed. G. The accounting principle that requires expenses to be reported in the same period as the sales they helped to produce. H. A written promise to pay a specified amount of money, usually with interest, either on demand or at a definite future date I. The party who signs a note and promises to pay it at maturity. J. The expected proceeds from converting an asset into cash.

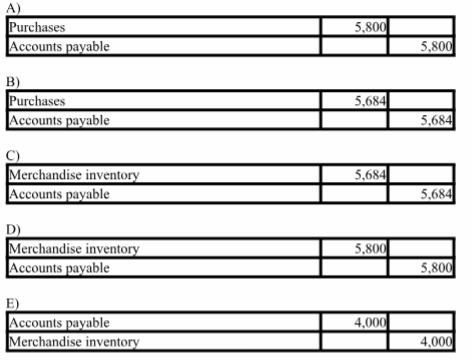

On September 12, Ryan Company sold merchandise in the amount of $5,800 to Johnson Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,000. Johnson uses the periodic inventory system and the net method of accounting for purchases. The journal entry that Johnson will make on September 12 is:

Which of the following actions cannot be used to eliminate a possible personal holding company tax liability involving a corporation owned by a mother and a father?

A. Make a deficiency distribution within 90 days of the date on which the IRS determines that a personal holding company liability is owed. B. Sell additional stock to other family members. C. Liquidate the corporation. D. Make a cash distribution within 2 1/2 months of the end of the tax year.