Tonya is the 100% shareholder of a corporation established five years ago. It has always been an S corporation. After adjustment for this year's corporate income, but before taking distributions into account, Tonya has a $50,000 stock basis. The corporation pays Tonya a $60,000 cash distribution. As a result of this distribution, Tonya will have an ending stock basis and recognized income of

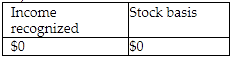

A)

B)

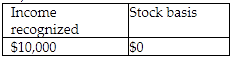

C)

D)

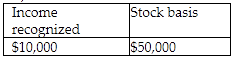

D)

Tonya's distribution is return of capital up to the level of her stock basis so the first $50,000 of the distribution is not taxable and reduces her stock basis to $0, but the excess $10,000 is taxable.

You might also like to view...

The journal entry to write down inventory to its market value results in a loss on the income statement

a. True b. False Indicate whether the statement is true or false

____ is the ability to last and produce results into the future.

a) Sustainability b) Innovation c) Social impact d) Entrepreneurship

Percentiles can be converted into quintiles and deciles, where quintiles divide the data into fifths, and deciles divide the data into tenths

Indicate whether the statement is true or false

When two conditions must both be true for the rows to be selected, the conditions are separated by the SQL AND keyword

Indicate whether the statement is true or false