How can irresponsible fiscal policy contribute to a speculative attack on a country's currency that is fixed in value to another currency?

What will be an ideal response?

Ensuring that a currency retains its value requires making sure that domestic inflation matches the inflation of the country to which the exchange rate is pegged. If politicians in the country begin to deficit spend, which can drive up inflation expectations, and if speculators believe the inflation rate is going to increase and that the current exchange rate cannot be maintained, a speculative attack on the currency will likely result.

You might also like to view...

If the U.S. Congress passes legislation to raise taxes to control demand-pull inflation, then this would be an example of a(n)

A. supply-side fiscal policy. B. contractionary fiscal policy. C. expansionary fiscal policy. D. nondiscretionary fiscal policy.

A decrease in input costs in the production of LCD televisions caused the price of LCD televisions to decrease. Holding everything else constant, how would this affect the market for video game consoles (a complement to LCD televisions)?

A) The supply of video game consoles would increase and the equilibrium price of video game consoles would decrease. B) The demand for video game consoles would decrease and the equilibrium price of video game consoles would decrease. C) The demand for video game consoles would decrease because consumers could afford to buy fewer LCD televisions and video game consoles. D) The demand for video game consoles would increase and the equilibrium price of video game consoles would increase.

An industry with a ________ long-run supply curve is called a constant-cost industry.

A. negative sloping B. horizontal C. positive sloping D. vertical

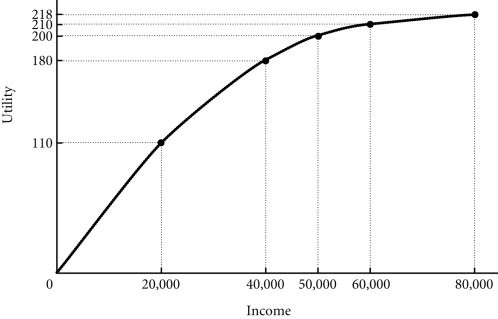

Refer to the information provided in Figure 17.1 below to answer the question(s) that follow.  Figure 17.1 Refer to Figure 17.1. Suppose John's utility from income is given in the figure. From this we would say that John is

Figure 17.1 Refer to Figure 17.1. Suppose John's utility from income is given in the figure. From this we would say that John is

A. risk-loving. B. risk-averse. C. a risk taker. D. risk-neutral.