What do Fannie Mae and Freddie Mac have in common?

A) They are both investment banks.

B) Both firms issue bonds on behalf of the government.

C) Both firms went out of business in the 2008 financial crisis.

D) They are both pension funds.

E) They are both government-sponsored mortgage lenders.

E

You might also like to view...

Banks earn a profit on the difference between: a. the interest charged from depositors and the interest offered to borrowers. b. the interest charged on loans and the interest paid on deposits

c. the deposit and loan balances. d. liabilities and deposits. e. dividends and interest.

One implication of the Condorcet paradox is

a. that the order in which things are voted on can affect the result. b. that the order in which things are voted on is irrelevant. c. that you do not want to be in charge of arranging which items are voted upon first. d. that when there are only two items being voted on the order matters.

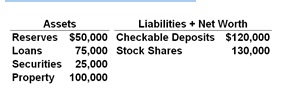

Answer the question based on the following balance sheet for the First National Bank. Assume the reserve ratio is 15 percent:

Refer to the above data. If the balance sheet was for the whole commercial banking system rather than a single bank, then loans and deposits could expand by a maximum of approximately:

A. $120,000

B. $213,333

C. $333,500

D. $415,373

In the United States, the board of directors of corporations have a fiduciary responsibility to:

A. set the prices of the products the corporation produces. B. represent the interest of its shareholders. C. operate the company on a day-to-day basis. D. raise investment capital in their spare time.