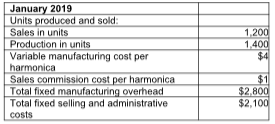

1. Compute the product cost per harmonica produced under absorption costing. 2. Prepare an income statement for January, 2019

Louie's Music produces harmonicas that it sells for $12 each. The company computes a

new monthly fixed manufacturing overhead allocation rate based on the planned number

of harmonicas to be produced that month. Assume all costs and production levels are

exactly as planned. The following data are from Louie's Music's first month in business:

You might also like to view...

The ________ market is the set of consumers who are buying the company's product

A) potential B) available C) target D) penetrated E) reserve

Substantive tests include

a. examining the safety deposit box for stock certificates b. reviewing systems documentation c. completing questionnaires d. observation

Operating leases are economically similar to purchasing assets with funds obtained from issuing long-term bonds and result in similar accounting

Indicate whether the statement is true or false

Ash, Bush and Cobb decide to liquidate their partnership. Net income or net loss is shared equally. The account balances are: Cash $4,000; Noncash Assets $44,000; Liabilities $8,000; Capital, Ash $10,000; Capital, Bush $20,000; Capital, Cobb $10,000 . If the noncash assets are sold for $50,000, Ash's final cash distribution will be:

a. $12,000 b. $10,000 c. $30,000 d. $18,000 e. $62,000