If a bond pays a fixed return of $500 a year and the current interest rate has risen from 5 percent to 10 percent, then the bond price must have:

a. risen from $25 to $50.

b. fallen from $50 to $25.

c. risen from $5,000 to $10,000.

d. fallen from $10,000 to $5,000.

e. risen from $1,000 to $5,000.

d

You might also like to view...

According to revealed preference a consumer that chooses to smoke cigarettes:

A. is minimizing their utility given the options available to them. B. derives more happiness from smoking than the goods they could have purchased with that same money. C. derives more utility from smoking than the goods they could have purchased with that same money. D. is behaving irrationally.

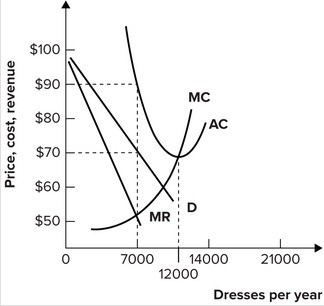

Refer to the graph shown of a monopolistically competitive firm. The graph shows that:

A. new firms will enter the industry. B. some existing firms will leave the industry. C. the price of the product is $90. D. the industry is in long-run equilibrium.

Which of the following statements is true of the economy in the long run? In the long run,

1. real GDP eventually moves to potential because all wages and prices are assumed to be flexible. 2. the economy can achieve its natural level of employment and potential output at any price level. 3. there is no cyclical unemployment. A. I only B. I and II only C. I and III only D. I, II, and III

Which of the following statements best illustrates the time-value of money concept?

A. Bob is willing to forgo receiving $100 today in order to receive $110 next month. B. Tom is indifferent between receiving $50 now and receiving $50 six months from now. C. Terry works for an hourly wage instead of a fixed salary. D. Jeff would prefer to receive $200 at the end of the year instead of $220 now.