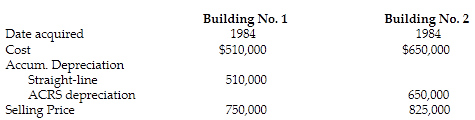

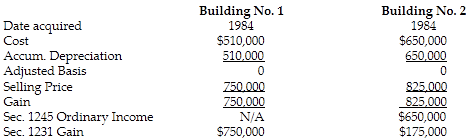

How much gain from these sales should be reported as Sec. 1231 gain and ordinary income due to depreciation recapture?

An unincorporated business sold two warehouses during the current year. The straight-line depreciation method was used for Building No. 1 and the accelerated method (ACRS) was used for Building No. 2. Information about those buildings is presented below.

Building No. 2 is considered Sec. 1245 property because ACRS was used.

You might also like to view...

All of the following were factors that precipitated the growth of MOTO except:

A. the national toll-free call system. B. the growth of the cellular phone industry. C. falling long distance telecommunications prices. D. the growth of the credit card industry.

When state law requires parties to a labor dispute to go to arbitration for a settlement, it is known as _______________________________ arbitration.

Fill in the blank(s) with the appropriate word(s).

In a ________ linear programming model, the solution values of the decision variables are zero or one

Fill in the blank with correct word.

Which of the following may a U.S. Court of Appeals not do in ruling on a case?

a. Reverse or modify the judgment of the lower court. b. Remand or send it back to the lower court. c. Rehear the case by taking testimony of the witnesses. d. Modify the judgment of the lower court.