Value maximization leads to predictable resource misallocation when the firm:

A. buys inputs from a monopsonist.

B. has monopoly power in the market.

C. sets price below long-run marginal cost.

D. operates in a competitive market.

Answer: B

You might also like to view...

Contrary to what the Phillips curve would have predicted, the U.S. economy in the 1970s experienced simultaneous increases in inflation and unemployment

a. True b. False Indicate whether the statement is true or false

A competitive market is one in which there

a. is only one seller, but there are many buyers. b. are many sellers, and each seller has the ability to set the price of his product. c. are many sellers, and they compete with one another in such a way that some sellers are always being forced out of the market. d. are so many buyers and so many sellers that each has a negligible impact on the price of the product.

A reduction in G or an increase in T would lead to lower real interest rates in the United States, a depreciating dollar, and, eventually, a smaller trade deficit..

Answer the following statement true (T) or false (F)

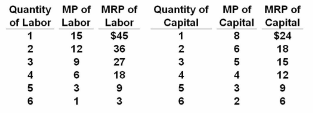

Refer to the given data. If the prices of labor and capital are $9 and $15 respectively, and labor and capital are the only inputs, the firm's economic profits will be:

A. $102.

B. $82.

C. $67.

D. $28.