Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.Larry Barnes, management consultant, earned $67,504.96

A. $8270.62, $1857.64

B. $8370.62, $1957.64

C. $4185.31, $1957.64

D. $4185.31, $978.82

Answer: B

Mathematics

You might also like to view...

Prove that the equation is an identity. =

=

What will be an ideal response?

Mathematics

Find the indicated intercept(s) of the graph of the function.y-intercept of f(x) =

A.

B.

C. (0, 6)

D. (0, 4)

Mathematics

Solve the problem.A parallelogram has a base of length 2x + 1 and a height of x + 3 and has an area of 42 square units. Find the base and height of the parallelogram. (A = bh)

A. height = 7 units; base = 6 units B. height = 3 units; base = 14 units C. height = 14 units; base = 3 units D. height = 6 units; base = 7 units

Mathematics

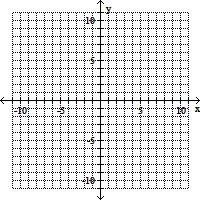

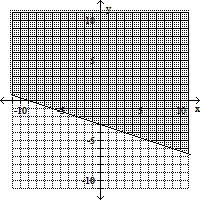

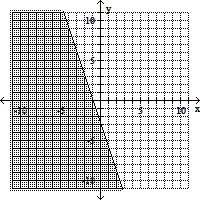

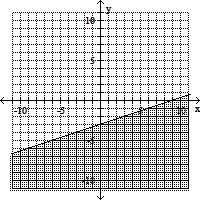

Graph the region described by the inequality.3x + y ? -3

A.

B.

C.

D.

Mathematics