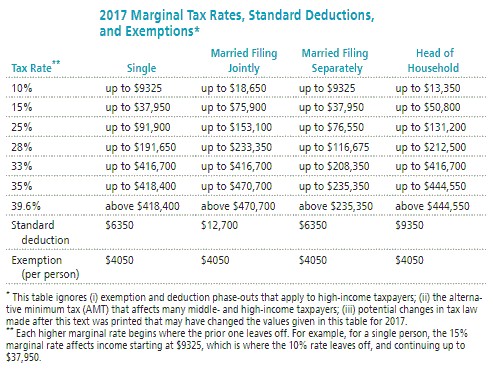

Solve the problem. Refer to the table if necessary. You are married filing jointly and have a taxable income of $257,431. You make monthly contributions of $926 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred contribution. If necessary, round values to the nearest dollar.

You are married filing jointly and have a taxable income of $257,431. You make monthly contributions of $926 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred contribution. If necessary, round values to the nearest dollar.

A. Take-home pay will be $3111 more per year with tax-deferred plan

B. Take-home pay will be $3667 more per year with tax-deferred plan

C. Take-home pay will be $3667 less per year with tax-deferred plan

D. Take-home pay will be $3111 less per year with tax-deferred plan

Answer: B

You might also like to view...

Solve the problem.Calculate the current yield for a $1000 Treasury bond with a coupon rate of 7.1% that has a market value of $750.

A. 10.41% B. 8.52% C. 9.47% D. 7.10%

Provide an appropriate response.Evaluate

What will be an ideal response?

Use the information given about the angle ?, 0 ? ? ? 2?, to find the exact value of the indicated trigonometric function.cos ? = -  , sin ? > 0Find cos

, sin ? > 0Find cos  .

.

A. -

B. -

C.

D.

Freud believed that the goal of the id was to do which of the following?

A. reduce satisfaction and maximize tension B. maximize satisfaction and reduce tension C. reduce inhibition and maximize unconscious awareness D. increase inhibition and reduce unconscious awareness