The income elasticity of demand is ________ if the good is ________ good

A) positive; a normal

B) positive; an inferior

C) negative; a normal

D) less than one; an inferior

E) positive; a substitute

A

You might also like to view...

Refer to Figure 9-9. Fenwick currently both produces and imports pistachios. The government of Fenwick decides to restrict international trade in pistachios by imposing a quota that allows imports of only 5 million pounds each year

Figure 9-9 shows the estimated demand and supply curves for pistachios in Fenwick and the results of imposing the quota. Answer questions a-j using the figure. a. If there is no quota what is the domestic price of pistachios and what is the quantity of pistachios demanded by consumers? b. If there is no quota how many pounds of pistachios would domestic producers supply and what quantity would be imported? c. If there is no quota what is the dollar value of consumer surplus? d. If there is no quota what is the dollar value of producer surplus received by producers in Fenwick? e. If there is no quota what is the revenue received by foreign producers who supply pistachios to Fenwick? f. With a quota in place what is the price that consumers of Fenwick must now pay and what is the quantity demanded? g. With a quota in place what is the dollar value of consumer surplus? Are consumers better off? h. With a quota in place what is the dollar value of producer surplus received by producers in Fenwick? Are domestic producers better off? i. Calculate the revenue to foreign producers who are granted permission to sell in Fenwick after the imposition of the quota. j. Calculate the deadweight loss as a result of the quota.

Consider a firm whose final output (and sales) in a particular year has a value of $1,200

To produce these goods, the firm used $500 worth of intermediate goods it had purchased in previous years plus $200 worth of newly-purchased intermediate goods. In the subsequent year, this same firm again sells $1,200 worth of final goods, but in this year has purchased $700 worth of intermediate goods, of which $100 is not used in current production but, rather, added to the firm's inventory. For each of these two years, calculate the value added by this firm. For each of these two years, calculate the contribution of this firm to the economy's GDP.

In June 2012, the public debt in the United States was approximately

A) $5.8 billion. B) $90 billion. C) $1.6 billion. D) $15.8 trillion. E) $120 trillion.

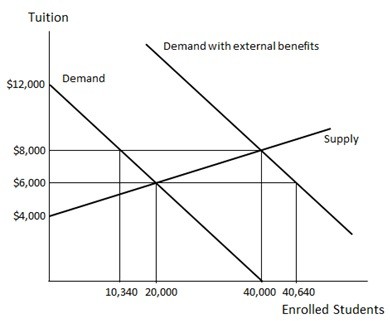

Examine Figure 36.1, which shows the market for K-12 education in an economy. If the market is unsubsidized, the equilibrium tuition fees per student for K-12 education is

A. $4,000. B. $8,000. C. $6,000. D. $12,000.