You agree to lend $1,000 for one year at a nominal interest rate of 10%. You anticipate that inflation will be 4% over that year. If inflation is instead 3% over that year, which of the following is true?

A) The real interest rate you earn on your money is lower than you expected.

B) The purchasing power of the money that will be repaid to you will be lower than you expected.

C) The person who borrowed the $1,000 will be worse off as a result of the unanticipated decrease in inflation.

D) The real interest rate you earn on your money will be negative.

Answer: C

You might also like to view...

A feature of perfect competition is

A) use of non-price competition by firms. B) mutual interdependence among firms. C) unique products. D) standardized products.

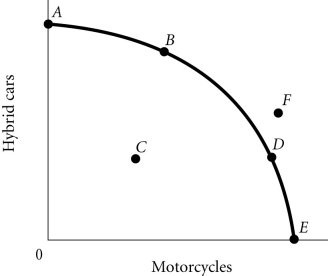

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point F

Figure 2.4According to Figure 2.4, Point F

A. is efficient and attainable. B. cannot be produced with the current state of technology. C. represents underallocation of resources. D. represents what the people want.

Part B of Medicare covers

A. doctor visits outside of a hospital. B. prescriptions taken out of the hospital. C. only charges incurred in a hospital. D. all health care needs.

If government legislates a price floor that is below the equilibrium price

A. a shortage will develop. B. a black market will soon develop. C. a surplus will develop. D. market price and quantity sold will be unaffected.