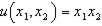

Suppose your tastes are defined by the utility function  .

.

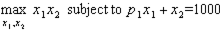

a. Suppose your income is $1,000, the price of  is 1 and the price of

is 1 and the price of

style="vertical-align: -7px;" width="15px" height="20px" align="absmiddle" /> is

b. Derive the quantity of

c. What happens to your consumption of

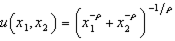

d. Now suppose that your and my tastes are captured by the utility function

What will be an ideal response?

b.

c. It remains the same.

d. Cobb-Douglas tastes are CES tastes with elasticity of substitution equal to 1. The elasticity of substitution in the CES function is given by

, with Cobb-Douglas tastes therefore having

, with Cobb-Douglas tastes therefore having  .If

.If  , the elasticity of substitution is less than 1, and if

, the elasticity of substitution is less than 1, and if  , the elasticity of substitution is greater than 1. The graphs below illustrate two scenarios --- the first with a high elasticity of substitution and the second with a low elasticity of substitution. In both cases, tastes are homothetic (as they are for CES preferences). A high elasticity of substitution implies that

, the elasticity of substitution is greater than 1. The graphs below illustrate two scenarios --- the first with a high elasticity of substitution and the second with a low elasticity of substitution. In both cases, tastes are homothetic (as they are for CES preferences). A high elasticity of substitution implies that  consumption increases with an increase in

consumption increases with an increase in  , and a low elasticity of substitution implies that

, and a low elasticity of substitution implies that  consumption decreases with an increase in

consumption decreases with an increase in  . In part (c), we found that Cobb-Douglas tastes fall at the border of these scenarios, which implies that

. In part (c), we found that Cobb-Douglas tastes fall at the border of these scenarios, which implies that  divides the two cases. For you,

divides the two cases. For you,  therefore lies between 0 and

therefore lies between 0 and  , while for me

, while for me  lies between 0 and -1.

lies between 0 and -1.

You might also like to view...

The argument that protection ________

A) penalizes poor environmental standards is true B) allows us to compete with cheap foreign wages is true C) is necessary for infant industries is true D) saves jobs is flawed

Refer to the above figure. Under monopsony, the wage rate will be

A) W1. B) W2. C) W3. D) W5.

Investment in physical capital means

A. purchasing supplies. B. purchasing equipment and buildings. C. taking out loans. D. hiring more employees.

The importance of the bank lending transmission mechanism of monetary policy:

A. has always been the weakest of all of the mechanisms. B. has decreased over the past thirty years. C. should continue to grow in importance. D. has increased over the past thirty years.