Explain the Keynesian theory of money demand. What motives did Keynes think determined money demand? What are the two reasons why Keynes thought velocity could NOT be treated as a constant?

What will be an ideal response?

Keynes believed the demand for money depended on income and interest rates. Money was held to facilitate normal transactions and as a precaution for unexpected transactions. For both of these motives, money demand depended on income. People also held money as an asset, for speculative purposes. The speculative motive depends on income and interest rates. People hold more money for speculative purposes when they expect bond prices to fall, generating a negative return on bonds. Since money demand varies with interest rates, velocity changes when interest rates change. Also, since money demand depends upon expectations about future interest rates, unstable expectations can make money demand, and thus velocity, unstable.

You might also like to view...

Even though monopolistic competition results in inefficiency, it does have which of the following benefits for society?

A) Firms earn zero economic profit in the long run. B) Firms can earn an economic profit in the short run. C) Product variety benefits consumers. D) Marginal cost equals price in the long run. E) The premise of the question is incorrect because nothing in monopolistic competition justifies any economic inefficiency.

The use of money as a medium of exchange requires a double coincidence of want

a. True b. False Indicate whether the statement is true or false

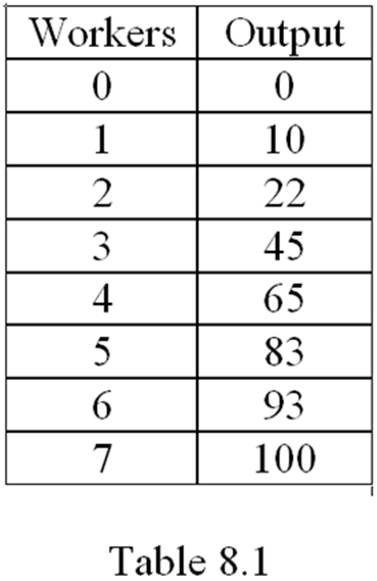

Refer to Table 8.1. Assume the wage rate is $10 and the firm has $1,000 in unavoidable fixed cost. What is the average variable cost of producing 22 units of output?

A. $0.91

B. $45.45

C. $0.45

D. $0.83

The market where businesses sell goods and services to households and the government is called the:

A. goods market. B. money market. C. capital market. D. factor market.