Suppose that wage contracts between workers and employers are based on an expected inflation rate of 3% and a 5% increase in money wages is agreed upon. If inflation actually equals 7%, real wages...

What will be an ideal response?

fall

You might also like to view...

The largest category of legal immigrants into the U.S. in 2011 was:

A. Family-sponsored immigrants B. Refugees C. Employment-based preferences D. Diversity immigrants

Suppose you would have to pay Alicia at least $150 to get her to part with a ticket she just bought to see her favorite band play next Friday. Loss aversion implies that if Alicia had not yet bought the ticket, she would:

A. be willing to pay exactly $150 for it. B. be willing to pay less than $150 for it. C. be willing to pay more than $150 for it. D. no longer be interested in purchasing it.

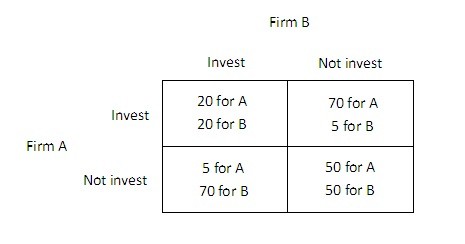

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. How much must the spy pay B?

An industry spy comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. How much must the spy pay B?

A. At least $15 million. B. At least $50 million. C. $0 D. At least $35 million.

Marginally attached workers

A. are not looking for work but indicate that they want and are available for a job and have looked for work sometime in the past 12 months. B. don't have jobs and are pessimistic about their chances of finding a suitable job. C. have a bad attitude towards work. D. are working part-time, but they want full-time work.