Use this information to answer the following question. These facts concern the long-term stock investments of Alpha Corporation: June 1, 2009 Paid cash for the following long-term investment: 5,000 shares Carey Corporation common stock (representing 5 percent of outstanding stock) at $40 per share; 3,000 shares Burns Corporation common stock (representing 3 percent of outstanding stock) at $24

per share. Dec. 31, 2009 Quoted market prices at year end: Carey common stock, $35; Burns common stock, $27. April 1, 2010 A change in policy required the sale of 1,000 shares of Carey Corporation common stock at $38. July 1, 2010 Received a cash dividend from Burns Corporation equal to $.30 per share. Dec. 31, 2010 Quoted market prices at year end: Carey common stock, $39; Burns common stock, $22. The entry to record the purchase of the Carey Corporation common stock is:

a. Long-Term Investments 272,000

Cash 272,000

b. Long-Term Investments 120,000

Cash 120,000

c. Long-Term Investments 72,000

Cash 72,000

d. Long-Term Investments 200,000

Cash 200,000

D

You might also like to view...

Which of the following statements is true about the willingness of foreign courts to enforce U.S. tort judgments?

A) Courts in several nations, including Germany and England, have ruled that punitive damage awards violate their public policy interest in maintaining a purely compensatory tort system. B) Germany and England are the only two countries whose courts have agreed to enforce U.S. punitive damages awards. C) Foreign courts have demonstrated a willingness to support awards of punitive damages, but they have refused to enforce the awards of nominal and compensatory damages. D) All foreign courts have demonstrated a willingness to enforce all U. S. tort judgments, including judgments for punitive, nominal, or compensatory damages.

If a capital budgeting project has a negative net present value (NPV),

A. its internal rate of return (IRR) is also negative. B. its discounted payback period (DPB) is greater than the project's economic life. C. the firm should invest in the project as long as the initial investment outlay is low. D. its traditional payback period (PB) is greater than the firm's expected payback period. E. its internal rate of return (IRR) is greater than the discount rate that would be used to compute the project's NPV.

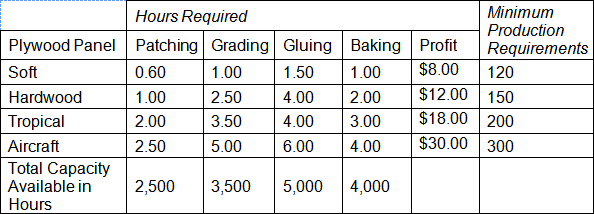

Diamond Plywood, Inc., manufactures four types of plywood panels. Each product must go through the following operations: patching, grading, gluing, and baking. The time in hours required for each operation for each panel, the total capacity available for each these operations in a given month, as well as the minimum production requirements and the profit contributions per panel are given in the following table. If Diamond Plywood wishes to increase its capacity in one of the four operations, which operation should it be?

a. patching

b. grading

c. gluing

d. baking

Which of the following contains a subset of data warehouse information?

A. Data mart B. Data analyzing tool C. Data pool D. Data miner