The real rate of interest equals 4% and the expected rate of inflation equals 2%. The nominal rate of interest equals

A. 6%.

B. -1%.

C. 2%.

D. 3%.

Answer: A

You might also like to view...

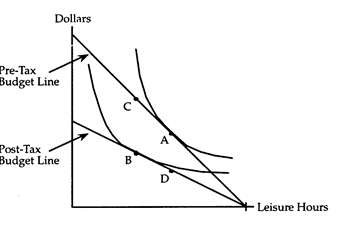

To measure the amount of tax money collected by the government, one uses the vertical distance between points

The accompanying diagram shows the effect of levying an income tax on the consumer. The pre-tax optimum is at point A, and the post-tax optimum is at point B.

a. A and B.

b. A and D.

c. B and C.

d. B and D.

Some mutual funds in the United States are now investing in stocks of foreign firms

By expanding to global financial markets, these mutual funds will be able to diversify their stock portfolios, allowing savers more options to spread their money among many financial investments. This is an example of A) risk sharing. B) providing information. C) investor securitization. D) decreasing liquidity.

Long-run full-employment equilibrium assumes: a. a downward-sloping production function

b. a downward-sloping long-run supply curve (LRAS). c. the CPI index price level equals the equilibrium wage rate. d. the CPI equals aggregate demand (AD) equals short-run aggregate supply (SRAS) equalslong-run aggregate supply (LRAS).

Starting from long run equilibrium, in response to a decrease in AD: a. The price level will increase more in the long run than in the short run

b. The short run equilibrium level of real output will be greater in the long run than in the short run. c. Neither the price level nor real output will change in the long run. d. Both a. and b. are correct