Ad valorem taxation means

A) that only the value added by a service provider is taxed.

B) that the tax rate is a percentage of the price paid for a product.

C) a negative income tax.

D) a progressive property tax imposed in some states.

Answer: B

You might also like to view...

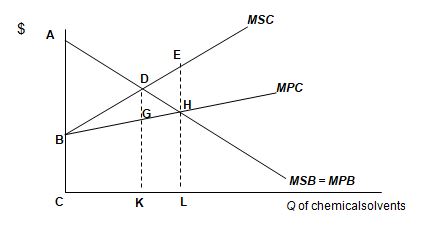

At QC, the maximum payment recreational users of the river would be willing to pay the producer for a unit change in output is

Consider the following graph of the market for chemical solvents, production of which damages a waterbody used for recreation.

a. DG b. DEH c. EH d. none of the above

All of the following statements would make a reasonable hypothesis to test except

A) Long-run economic growth leads to higher real GDP per capita. B) An inflation rate below 3% is good for an economy. C) Increasing tax rates eventually lead to a decrease in work effort. D) Decreases in the unemployment rate lead to increases in the rate of inflation.

PPP-adjustment involves:

A. recalculating economic statistics to account for differences in price levels across countries. B. a method very similar to adjusting to cost-of-living increases using a price index like the CPI. C. recalculating a variable like GDP per capita so we can compare someone's standard of living across countries. D. All of these statements are true.

Suppose in the year 2000 Ken earned $60,000 per year and that in 2015 he earned $78,000 per year. If the CPI in the year 2000 was 172.2 and in 2015 was 236.7, which of the following statements is correct? a. Ken's standard of living got better from 2000 to 2015

b. If Ken had earned $81,000 in 2015, his standard of living would have improved relative to his income in 2000. c. Ken would have needed to earn $87,000 or more in 2015 for his standard of living to have improved relative to his income in 2000. d. If Ken had earned $83,000 in 2015, his standard of living would have improved relative to his income in 2000.