Software systems can be divided into how many basic functions?

a. 1

b. 2

c. 3

d. 4

e. 5

Answer : d. 4

You might also like to view...

Always Fresh Produce Company has a route selling to more than 100 groceries, schools, and restaurants at wholesale prices. Last week, the owners opened up a walk-in discounted consumer produce outlet

Always is now using a multichannel distribution system. Indicate whether the statement is true or false

A sequential interview is usually shorter than a one-on-one interview

Indicate whether the statement is true or false

Sky Pioneers Inc. manufactures airplane parts. It wants to globalize and is willing to spend a considerable amount to protect its intellectual property. Which of these business ventures makes the most sense for Sky Pioneers?

A. licensing some of its newest designs to overseas competitors B. exporting airplane parts to many other countries C. acquiring an airplane-parts manufacturer in another country D. beginning a brownfield project in its home country

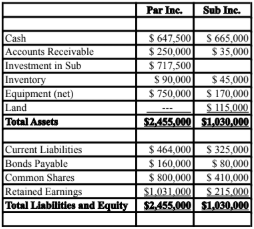

Prepare Par's consolidated balance sheet as at the date of acquisition.

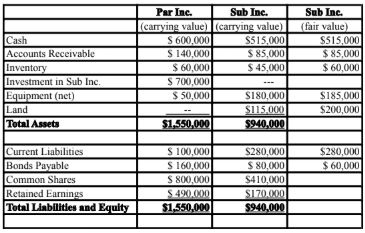

Par Inc. purchased 70% of the outstanding voting shares of Sub Inc. for $700,000 on July 1, 2015. On that date, Sub Inc. had common shares and retained earnings worth $410,000 and $170,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Sub's bonds mature on July 1, 2020. The inventory was sold in the year following the acquisition. Both companies use straight line amortization, and no salvage value is assumed for assets. Par Inc. and Sub Inc. declared and paid $10,000 and $5,000 in dividends, respectively during the year.

The balance sheets of both companies, as well as Sub's fair values immediately following the acquisition are shown below:

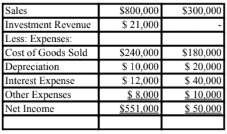

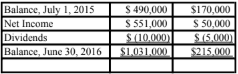

The following are the financial statements for both companies for the fiscal year ended June 30, 2016:

Income Statements

Retained Earnings Statements

Balance Sheets

Both companies use a FIFO system, and Sub's entire inventory on the date of acquisition was sold during the following year. During 2015, Sub Inc. borrowed $10,000 in cash from Par Inc. interest free to finance its operations. Par uses the Equity Method to account for its investment in Sub Inc. Corp.