If Gordon’s average tax rate is 10 percent when he earns $100 and his average tax rate is 10.25 percent when he earns $101, then

A. his marginal tax rate is 0.25 percent.

B. his marginal tax rate is 35.25 percent.

C. his marginal tax rate is 25.25 percent.

D. his marginal tax rate is 25 percent.

Answer: B

You might also like to view...

The Constitution created an environment conducive to economic growth and development because the federal government could constitutionally do all of the following except

(a) Levy uniform taxes (b) Coin money and regulate its value (c) Regulate commerce, thus prohibiting states from erecting barriers to the interstate movement of goods (d) Set "fair" prices on the private sale of goods in the marketplace

A monopolistically competitive firm is producing an output level at which marginal revenue is greater than marginal cost. This firm should __________ quantity and __________ price to increase profit or reduce losses

a. increase, increase b. increase; decrease c. decrease; increase d. decrease; decrease e. increase; not change

If the spending multiplier is equal to 5, then a $1 initial increase in investment spending will lead to a:

a. 5 percent decrease in real GDP. b. 5 percent increase in real GDP. c. $5 decrease in real GDP. d. $5 increase in real GDP. e. 0.05 percent increase in real GDP.

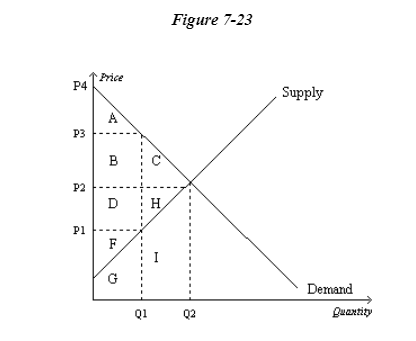

Refer to Figure 7-23. The equilibrium price is

a. P1

b. P2

c. P3

d. P4