Consider the following statements about the investment in working capital in a capital budgeting analysis:Working capital often increases as the result of higher balances in accounts receivable or inventory necessary to support a project.

Working capital increases are sources of cash and should be included in a discounted-cash-flow analysis.

The time 0 cash investment in working capital is included in a discounted-cash-flow analysis as a cash outflow.

Which of the above statements is (are) correct?

A. III only.

B. I and II.

C. I and III.

D. I only.

E. II only.

Answer: C

You might also like to view...

Residual value is notincorporated in the initial calculations for double-declining-balance depreciation

a. True b. False Indicate whether the statement is true or false

An image a project team holds in common about how the project will look upon completion, how they will work together, and/or how customers will accept the project is known as a(n) ________. It is a less tangible aspect of project performance.

Fill in the blank(s) with the appropriate word(s).

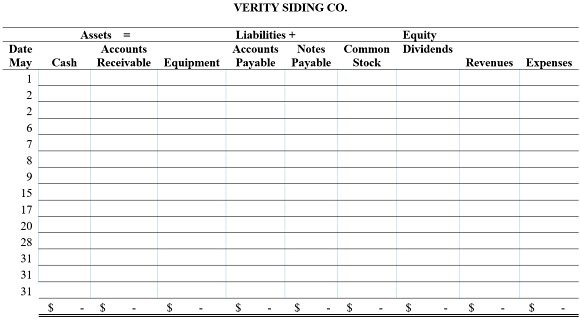

Verity Siding Company, owned by S. Verity, its sole stockholder, began operations in May and completed the following transactions during that first month of operations. Show the effects of the transactions on the accounts of the accounting equation by recording increases and decreases in the appropriate columns in the table below. Do not determine new account balances after each transaction. Determine the final total for each account and verify that the equation is in balance.May 1S. Verity invested $90,000 cash in the company in exchange for common stock.?2The company purchased $25,000 in office equipment. It paid $10,000 in cash and signed a note payable promising to pay the $15,000 over the next three years.?2The company rented office space and paid $3,000 for the May rent.?6The

company installed new vinyl siding for a customer and immediately collected $5,000.?7The company paid a supplier $2,000 for siding materials used on the May 6 job.?8The company purchased a $2,500 copy machine for office use on credit.?9The company completed work for additional customers on credit in the amount of $16,000.?15The company paid its employees' salaries $2,300 for the first half of the month.?17The company installed new siding for a customer and immediately collected $2,400.?20The company received $10,000 in payments from the customers billed on May 9.?28The company paid $1,500 on the copy machine purchased on May 8. It will pay the remaining balance in June.?31The company paid its employees' salaries $2,400 for the second half of the month.?31The company paid a supplier $5,300 for siding materials used on the remaining jobs completed during May.?31The company paid $450 for this month's utility bill.

What will be an ideal response?

Merrell Enterprises had the following purchases budgeted for the last six months of 2013: July $100,000 August 80,000 September 90,000 October 70,000 November 90,000 December 100,000 Merrell pays one-half of a month's purchases in the month of purchase and the remainder in the following month. What are expected total cash disbursements for the last quarter of 2013?

A) $210,000 B) $255,000 C) $130,000 D) $260,000