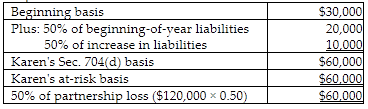

On the first day of the partnership's tax year, Karen purchases a 50% interest in a general partnership for $30,000 cash and she materially participates in the operation of the partnership for the entire year. The partnership has $40,000 in recourse liabilities when Karen enters the partnership. Partners share the economic risk of loss from recourse liabilities in the same way they share

partnership losses. There is no minimum gain related to the nonrecourse liability. During the year, the partnership incurs a $120,000 loss and a $20,000 increase in liabilities. How much of the loss can Karen report on her tax return for the current year?

A) $30,000

B) $40,000

C) $50,000

D) $60,000

D) $60,000

The loss is deductible only to the extent of Karen's at-risk basis, or $50,000.

You might also like to view...

What are articles of partnership?

What will be an ideal response?

Why do firms have difficulty accessing potential market areas in developing countries, such as China and India?

A) inadequate distribution systems B) anti-globalization efforts C) highly centralized rural markets D) limited manpower E) high operating costs

Which of the following most accurately identifies the purpose of a marketing-mix model?

A) to identify the most appropriate target audience for a new product B) to evaluate the contribution that each component of a marketing program makes to market performance C) to identify the most effective media strategies to use to reach a target audience D) to evaluate the effect of supply and price on level of customer demand E) to select the most efficient marketing channels for a given product

Which of the following expenses for accounting purposes generates an indirect after-tax cash inflow for purposes of net present value computations?

A) Repairs expense B) Salaries expense C) Depreciation expense D) Tax expense