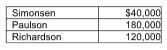

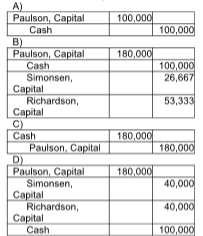

Paulson is retiring from the partnership on December 31, 2018. The profit-and-loss-sharing ratio among Simonsen, Paulson, and Richardson is 1:3:2, in the order given. Paulson is paid $100,000 cash in full compensation for her capital account balance. Which of the following journal entries would the firm record for this transaction? (Round the final answer to the nearest dollar.)

Simonsen, Paulson, and Richardson are partners in a firm with the following capital account

balances:

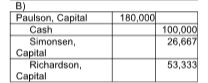

The withdrawing partner may be so eager to depart that he or she will take less than his or

her full capital balance. Paulson withdraws from the business and agrees to receive cash of $100,000.

This settlement is $80,000 less than Paulson's capital account balance. The remaining partners

(Simonsen and Richardson) share this $80,000 difference according to their existing profit-and-loss-sharing ratio (1:2).

You might also like to view...

Discuss and exemplify how the Q&A session can be advantageous to both the speaker and audience.

What will be an ideal response?

Mcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on 20,000 direct labor-hours, total fixed manufacturing overhead cost of $182,000, and a variable manufacturing overhead rate of $2.50 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:?Total direct labor-hours250?Direct materials$740?Direct labor cost$6,500Required:Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%.

What will be an ideal response?

Which of the following is not a reason investors purchase bonds?

A) Conservative investment B) Pay periodic income C) May be convertible D) Have high risk and return

Which component of the Internet mindset is focused on providing an interactive customer experience with the company?

A) eliminate mass market communication B) eliminate broadcast customer contact C) customer time frame D) bottom-up culture