Assume that business investment spending rises, and the increase is funded by greater borrowing in the capital markets. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the quantity of real loanable funds per time period and current international transactions in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period falls and current international transactions become more negative (or less positive).

b. The quantity of real loanable funds per time period rises and current international transactions become more negative (or less positive).

c. The quantity of real loanable funds per time period and current international transactions remain the same.

d. The quantity of real loanable funds per time period rises and current international transactions remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.B

You might also like to view...

Which of the following is not a method to internalize or adjust for externalities?

A. persuasion B. assignment of property rights C. unilateral transfers D. voluntary agreements

Perfect Competition is an industry in which there is only one supplier of a product that has no close substitutes.

Answer the following statement true (T) or false (F)

The supply curve of bonds is graphed as a vertical line

Indicate whether the statement is true or false

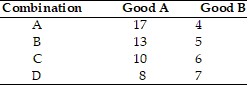

Refer to the above table. The table gives the various combinations of Good A and Good B along Jane's indifference curve. The marginal rate of substitution when Jane goes from combination C to combination D is

Refer to the above table. The table gives the various combinations of Good A and Good B along Jane's indifference curve. The marginal rate of substitution when Jane goes from combination C to combination D is

A. 4:1. B. 3:1. C. 2:1. D. 0.