Generally, on a linear two-good production possibilities curve, the opportunity cost of the good measured on the vertical axis is:

A. one minus the opportunity cost of the good measured on the horizontal axis.

B. the negative of the opportunity cost of the good measured on the horizontal axis.

C. the reciprocal of the opportunity cost of the good measured on the horizontal axis.

D. the absolute value of the slope of the production possibilities curve.

Answer: C

You might also like to view...

In a 2-firm oligopoly, if you can choose to either be a simultaneous move Cournot competitor or a Stackelberg leader, you will always choose to be a Stackelberg leader.

Answer the following statement true (T) or false (F)

You review a salesman's income over a 5-year period. You note it fluctuates tremendously from year to year, yet his consumption of goods and services remains consistently at the same level, year after year

Does this mean that income is not a determinant of consumption, or could something else explain his behavior?

If the prices of financial assets follow a random walk, then

A) they should be easy to forecast, provided market participants have rational expectations. B) they should be easy to forecast, provided market participants have adaptive expectations. C) the change in price from one trading period to the next is not predictable. D) major traders in the market must not be making use of all available information about the assets.

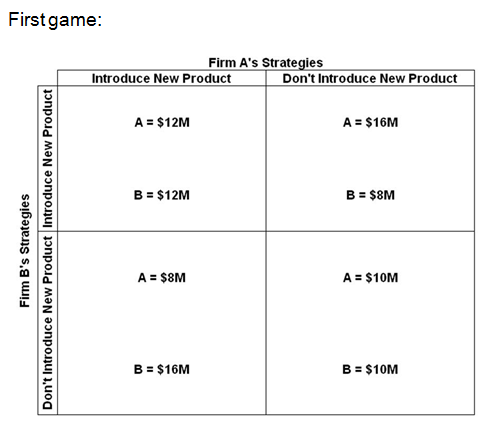

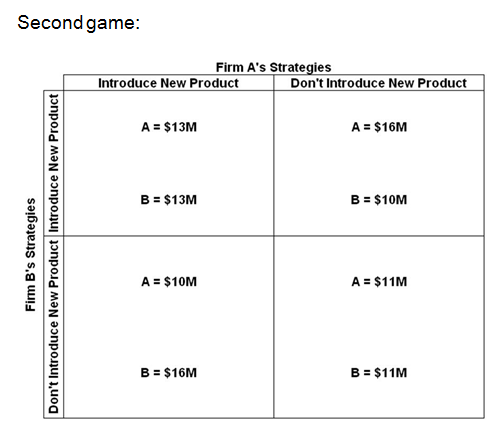

Refer to the below table. In the first game, if firm B doesn't introduce a new product and firm A does, then firm A would be better off if:

Answer the question based on the following payoff matrices for a repeated game involving two firms that are considering introducing new products to the market. The numbers indicate the profit from following either a strategy to introduce a new product or a strategy to not introduce a new product.

A. Both firms introduce new products in game 2

B. Neither firm introduces new products in game 2

C. Firm B reciprocates in game 2

D. Game 2 reaches a Nash equilibrium