In 2007, which of the following U.S. firms showed the first indication of significant problems in the financial sector?

A. AIG

B. Bear Stearns

C. J.P. Morgan Chase

D. Lehman Brothers

Answer: B

You might also like to view...

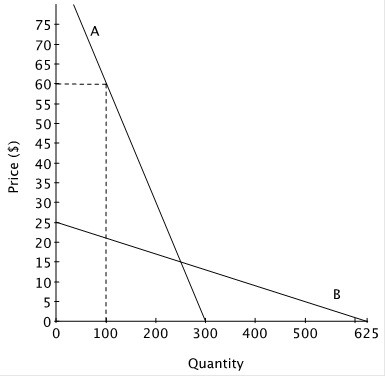

Suppose that a new drug has been approved to treat a life-threatening disease. The demand for that drug is shown on the graph below. Prior to approval of this drug, the only treatment for this condition was any one of several non-prescription, or over-the-counter, pain relievers. The demand for one brand of the several non-prescription pain relievers is also shown on the graph.  If the manufacturer of the new drug chose to increase its price from $70 to $75, consumers would buy ________ doses, and have ________ total expenditures.

If the manufacturer of the new drug chose to increase its price from $70 to $75, consumers would buy ________ doses, and have ________ total expenditures.

A. more; higher B. more; lower C. fewer; higher D. fewer; lower

In the figure above, the marginal rate of substitution (MRS) at point A is equal to ________ pounds of pickles per pound of olives

A) 8 B) 6 C) 1 1/3 D) 2

Prior to 2008, bank managers looked on reserve requirements

A) as a tax on deposits. B) as a subsidy on deposits. C) as a subsidy on loans. D) as a tax on loans.

According to Modigliani's life-cycle hypothesis, the

a. MPC for young adults is relatively low b. middle-aged experience their highest and most rapidly growing MPCs c. MPC falls during middle-age d. MPC falls during old age e. MPC is constant throughout a lifetime