Assume that the government increases spending and finances the expenditures by borrowing in the domestic capital markets. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the GDP Price Index and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. The GDP Price Index rises, and net nonreserve-related international borrowing/lending becomes more positive (or less negative).

b. The GDP Price Index rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive).

c. The GDP Price Index falls, and net nonreserve-related international borrowing/lending becomes more positive (or less negative).

d. The GDP Price Index and net nonreserve-related international borrowing/lending remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.A

You might also like to view...

Using the figure above, suppose with no trade Liz and Joe each produce at point A on their respective PPFs. Then, Joe suggests that they specialize and trade. He would produces only salads and Liz would produce only smoothies

Then, Joe says, he would buy 16 smoothies from Liz at a price of 1.5 salads per smoothie. Liz should A) accept Joe's offer since she will gain 4 smoothies and 4 salads. B) accept Joe's offer as she will be as well off as with no trade. C) not accept Joe's offer as the price he offers is too low for her to gain from trade. D) not accept Joe's offer since she would lose 2 smoothies and 2 salads. E) accept Joe's offer since she will gain 4 salads.

All of the following are ways in which government can promote economic development except

a. encouraging foreign direct investment b. nationalizing industries to create efficiency c. encouraging competition d. providing an infrastructure e. promoting saving and investment

When marginal utility of consuming a good is zero, total utility is:

A. zero. B. decreasing. C. increasing. D. at its maximum.

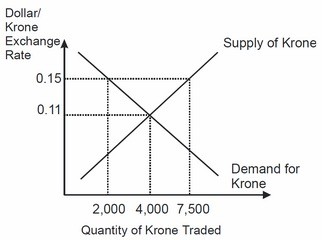

Based on this figure, in order to maintain an exchange rate of $0.15 dollars per Norwegian krone, the Norwegian government will have to spend (in dollars)_____ worth of international reserves per period.

A. $300 B. $825 C. $2,000 D. $5,500