The income elasticity of demand for a good that is extremely necessary for the existence of its consumers is close to zero

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

The cost of producing a good or service that is paid by people other than the producers is

A) the marginal cost. B) represented by the demand curve. C) represented by the supply curve. D) an external cost.

If the elasticity of demand is much greater than the elasticity of supply, an excise tax levied on the suppliers will

a. cause the suppliers to incur a greater burden of the tax than demanders b. cause the demanders to incur a greater burden of the tax than suppliers c. the burden of the tax will be shared equally between the suppliers and the demanders d. cause the entire burden of the tax to rest on the demanders e. Without more information as to the amount of the excise tax, who will incur a greater burden will be unclear

Transfer payments:

What will be an ideal response?

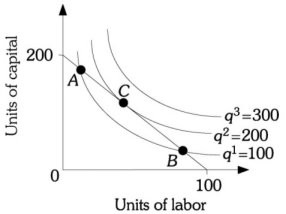

Refer to the information provided in Figure 7.11 below to answer the question(s) that follow.  Figure 7.11

Refer to Figure 7.11. If the firm's cost of capital is $30 per unit and its cost of labor is $60 per unit, the isocost line represents a total cost of

Figure 7.11

Refer to Figure 7.11. If the firm's cost of capital is $30 per unit and its cost of labor is $60 per unit, the isocost line represents a total cost of

A. $2,000. B. $3,000. C. $6,000. D. $8,000.