In the late 1990's, the Wall Street Journal suggested that the stock market is grossly undervalued even while it is breaking all time records monthly. Its argument was that the risk factor of stock was being reduced dramatically due to increased stability in the economy and the prospects for continued long-term growth. Illustrate how this assumption about the economy leads to a rational bidding up of stock prices.

What will be an ideal response?

If the stock return is twice the return on a low risk bond and then the risk from the stock is eliminated, the value of the stock would double. For example, a $100 risk free bond earning 6% a year will return $6 in earnings that are guaranteed. A $100 share of stock earning $12 a year 50% of the time will give the same income as the bond over time. But if the $12 return becomes a yearly return with little or no risk than people will be willing to bid up to $200 for the stock. The WSJ article indicated that the appropriate value for the Dow Jones might be in the neighborhood of 36,000. Too bad the article underestimated the risks.

You might also like to view...

Of the three major economic questions, which of the following is the best example of a "What?" question?

A) Should we make faster microprocessors or pest-resistant corn? B) Should higher-income or lower-income people buy SUVs? C) What should doctors be paid? D) Should automobiles be produced using workers or robots? E) Should migrant workers or domestic workers be used to pick grapes?

When there are economies of scale over the relevant range of output for a monopoly, the monopoly

a. is a natural monopoly. b. is a government-granted monopoly. c. has monopoly power due to the ownership of a patent or copyright. d. has monopoly power due to the ownership of a key production resource.

When would it make sense for a factory that is losing money to remain in operation?

(A) If the revenue from the goods being manufactured exceeds the operating cost. (B) If marginal revenue is equal to marginal cost. (C) If total cost of the goods being manufactured exceeds the operating cost. (D) If marginal product of labor becomes negative.

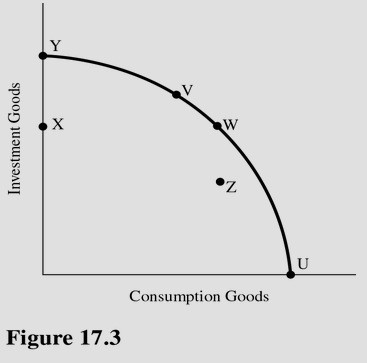

Refer to Figure 17.3. Assume X units of plants and equipment wear out each year. What will happen to the PPC in the future if the economy currently produces at point U?

Refer to Figure 17.3. Assume X units of plants and equipment wear out each year. What will happen to the PPC in the future if the economy currently produces at point U?

A. It will shift outward. B. It will shift inward. C. It will stay the same. D. This cannot be determined with the information given.