General partners have unlimited personal liability for the debts and obligations of the partnership

Indicate whether the statement is true or false

TRUE

You might also like to view...

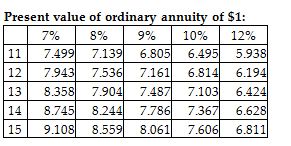

Compute the present value of an ordinary annuity that pays $13,000 per year for 15 years at 10%.

A) $98,878

B) $99,745

C) $97,578

D) $100,178

Sanborn, Inc, leased equipment from Chase Supply on December 31 . 2014 . The lease term is for the 10-year period expiring December 30, 2021 . The useful life of the leased asset is 1 . years. Equal annual payments under the lease are $100,000 due on December 31 of each year. The first payment was made on December 31 . 2014 . Sanborn's incremental borrowing rate was 12% at December 31 . 2014

Chase's implicit rate for the lease is 10% and is known by Sanborn. Sanborn appropriately accounts for the lease as a capital lease. What is the balance in Sanborn's "Liability Under Lease Agreements" account at December 31 . 2015? a. $533,492 b. $545,010 c. $643,492 d. $800,000

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.Demers earns income and pays dividends as follows: 2019 2020 2021Net income$100,000 $120,000 $130,000 Dividends 40,000 50,000 60,000 ??Assume the initial value method is applied.?How much does Pell record as Income from Demers for the year ended December 31, 2021?

A. $98,400. B. $56,000. C. $97,000. D. $48,000. E. $50,400.

The difference between the capital gains tax rate and the income tax rate is an incentive for

A) firms to pay more earnings as dividends. B) firms to declare more stock dividends. C) firms never to split their stock. D) firms to retain more earnings.