You can purchase a treasury note today for 94.2 percent of its face value of $20 000. Every six months you will receive an interest payment at the annual rate of 4.88 percent of face value. You can then invest your interest payments at the annual rate of 5.0 percent compounded semiannually. If the note matures six years from today, how much money will you receive from all the investments? Express this also as an annual rate of return.

What will be an ideal response?

ANSWER.png)

You might also like to view...

How do we treat severe burns?

What will be an ideal response?

For classroom projects, you will probably need to convey to your instructor how each person on the team contributed to the overall project. Specifically, what questions should you address?

What will be an ideal response?

Which of the following is NOT a challenge of leadership mentioned in the text?

a. diversity b. multiple constituencies c. global competition d. unpopular decisions e. All of these are challenges of leadership.

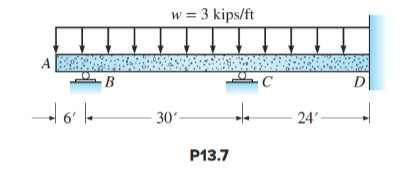

The beam in Figure P13.7 is indeterminate to the second degree. Assume the location of the minimum number of points of inflection required to analyze the beam. Compute all reactions and draw the shear and moment diagrams. Check the results using moment distribution.