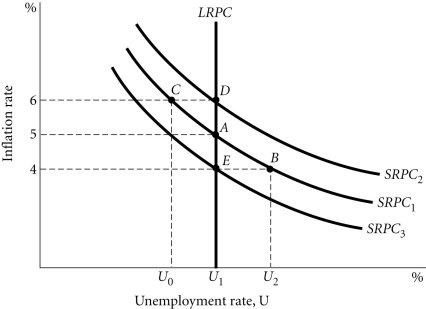

Refer to the information provided in Figure 28.7 below to answer the question(s) that follow. Figure 28.7Refer to Figure 28.7. Which combinations of events could move the economy from Point A to Point B, and then from Point B to Point E?

Figure 28.7Refer to Figure 28.7. Which combinations of events could move the economy from Point A to Point B, and then from Point B to Point E?

A. an expansionary fiscal policy followed by a leftward shift in the AS curve

B. a contractionary monetary policy followed by a rightward shift in the AS curve

C. an expansionary fiscal policy followed by a rightward shift in the AS curve

D. a contractionary monetary policy followed by a leftward shift in the AS curve

Answer: B

You might also like to view...

The current yield is equal to

A) the coupon divided by the market price of the bond. B) the yield to maturity, if the bond is a coupon bond. C) the coupon divided by the par value of the bond. D) the market price of the bond divided by its par value.

If a retail food chain merged with a meat packing company, this would be an example of a

A) horizontal merger. B) conglomerate merger. C) vertical merger. D) diagonal merger.

If the inflation rate during a particular year is 2 percent, then the real interest rate that a lender will receive from a loan that promises a nominal interest rate of 10 percent is _____

a. 12 percent b. 8 percent c. 10 percent d. 2 percent

Answer the following statements true (T) or false (F)

1) The higher the interest rate, the larger will be the amount of money demanded for transaction purposes. 2) The asset demand for money varies inversely with the nominal GDP. 3) Bond prices and interest rates are directly or positively related. 4) The Fed reduces interest rates mainly by selling government securities.