If Jenny’s taxes are $10,000 when she earns $50,000 and $12,000 when she earns $60,000, then

A. Jenny faces a progressive tax.

B. Jenny faces a regressive tax.

C. Jenny faces a proportional tax.

D. Jenny faces a rising marginal tax rate.

Answer: C

You might also like to view...

Which of the following is not included in the M1 category?

a. Currency b. Checkable deposits c. Traveler's checks d. Savings deposits

The yardstick most often used to compare living standards is:

a. aggregate demand b. Gross National Product c. output per capital d. international investment

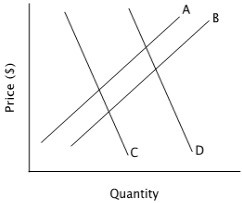

Refer to the accompanying figure. An increase in demand is represented by a shift from:

A. curve A to curve B. B. curve D to curve C. C. curve C to curve D. D. curve B to curve A.

A U-shaped long-run average cost curve implies that a firm faces only diseconomies of scale.

Answer the following statement true (T) or false (F)