The interest rate the Fed charges commercial banks for borrowing funds is the

A. discount rate.

B. prime rate.

C. open market rate.

D. federal funds rate.

Answer: A

You might also like to view...

When the price of a good changes, other things constant, what occurs?

A) The supply curve shifts to the right. B) The supply curve shifts to the left. C) The supply curve becomes flatter. D) The supply curve becomes steeper. E) Only quantity supplied changes.

Special Drawing Rights (SDRs) are issued to governments by the ________ to settle international debts and have replaced ________ in international transactions

A) Federal Reserve System; gold B) Federal Reserve System; dollars C) International Monetary Fund; gold D) International Monetary Fund; dollars

A person who is risk averse might accept a 50% chance of losing $100 today in exchange for a 50% chance of winning $125 in two years if the interest rate was

a. 9% but not 10% b. 10% but not 11% c. 11% but not 12% d. None of the above is correct; a risk averse person would not accept any of the above bets.

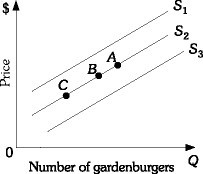

Refer to the information provided in Figure 3.11 below to answer the following question(s). Figure 3.11Refer to Figure 3.11. A decrease in the wage rate of gardenburger makers will cause a movement from Point B on supply curve S2 to

Figure 3.11Refer to Figure 3.11. A decrease in the wage rate of gardenburger makers will cause a movement from Point B on supply curve S2 to

A. supply curve S3. B. Point A on supply curve S2. C. supply curve S1. D. Point B on supply curve S2.