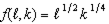

Suppose all firms in a perfectly competitive industry have production processes characterized by the production function  . Suppose the cost of labor is 20 and the cost of capital is 10.

. Suppose the cost of labor is 20 and the cost of capital is 10.

a. Suppose that the industry is in long run equilibrium and that firms are using 1 unit of capital. What is the short run cost function of each firm?

b. Suppose there are 5,000 firms in long run equilibrium. What is the short run market supply function?

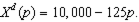

c. Suppose market demand is

d. Firms in this industry face a recurring fixed cost FC. What must FC be in order for this industry to indeed be in long run equilibrium with its 100 firms?

What will be an ideal response?

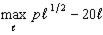

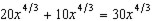

This implies the short run profit maximization problem

This implies the short run profit maximization problem  which solves to

which solves to  Substituting this into the short run production function, we get the short run supply function

Substituting this into the short run production function, we get the short run supply function

b. The SR market supply function is

c. The equilibrium price is found by setting the supply function from (b) equal to the demand function and solving for p. This gives us p*=40.

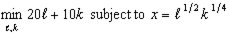

d. For this to be a long run equilibrium, it must be that the lowest point of the long run AC curve happens at an AC of 40. So first we have to calculate the long run AC curve by solving the cost minimization problem

to get the conditional input demands

to get the conditional input demands  and

and  . These then give us a cost for the inputs of

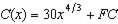

. These then give us a cost for the inputs of  . Adding the fixed cost, we have a long run cost function of

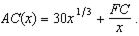

. Adding the fixed cost, we have a long run cost function of  and an average cost function of

and an average cost function of  Taking the derivative of the AC function and setting it to zero, we get that the lowest point of the AC function occurs at

Taking the derivative of the AC function and setting it to zero, we get that the lowest point of the AC function occurs at  . Given our answers to (a) and (b), each firm must be producing 1 unit of output (at a price of 40) -- so we solve

. Given our answers to (a) and (b), each firm must be producing 1 unit of output (at a price of 40) -- so we solve  which gives us FC=10. Plugging that back into the AC curve when x=1, we indeed get AC=40.

which gives us FC=10. Plugging that back into the AC curve when x=1, we indeed get AC=40.You might also like to view...

According to your text, one reason for flat or falling achievement scores even in the face of substantially higher education subsidies may be that

A) the additional funds are being siphoned off by dishonest school board members. B) some of the funds are going to social services rather than to enhance learning activities. C) students are so unmotivated that no amount of spending will ever improve scores. D) most parents do not support the schools or their children's educational activities.

The new Keynesian economists believed that:

a. wages and prices are flexible in the short run. b. wages are flexible but prices are not flexible in the long run. c. wages are not flexible but prices are flexible in the short run. d. wages and prices are not flexible in the short run. e. wages and prices are not flexible in the long run.

Economic studies of lottery winners and people who have inherited large amounts of money show that

a. the income effect of winning the lottery or inheriting large amounts of money likely outweighs the substitution effect for most people. b. the substitution effect of winning the lottery or inheriting large amounts of money likely outweighs the income effect for most people. c. most people view leisure as an inferior good. d. most people's labor supply is unaffected by changes in wealth.

The manager of the bank where you work tells you that your bank has $6 million in excess reserves. She also tells you that the bank has $400 million in deposits and $362 million dollars in loans. Given this information you find that the reserve requirement must be

a. 44/400. b. 6/362. c. 38/400. d. 32/400.